Of all the trials and tribulations faced by first-time entrepreneurs, there is one vital thing that is a frequent contributor to their downfall - financial planning. Lots of people have great ideas every day - a few of them will, eventually, turn them into a business. But all that hard work and all those dreams will end in a failure if you aren’t planning your finances properly. Here are a few things that should be on your mind as a first-time entrepreneur - make sure they are in your financial planning if you want to avoid disaster.

Separate your personal and business lives

The first step is to ensure that your personal money and your business finances are separated. Not just regarding setting up a business account, either. As a first-time entrepreneur, you will need to put a lot of our personal cash into starting up your business, and it can be difficult to control both aspects of your financial life - one can quickly encroach into another. Make sure that you have enough money to survive, too - a financial advisor might be able to help you get off on the right foot.

Lay the right foundations

Many new businesses start off in a big way but quickly peter into nonexistence. Why? Because they run out of money, in the vast majority of cases. Ensure your fledgling company doesn’t go the same way by finding an accountant who you can work with to give your business the best possible foundation. According to Raffingers, a good accountant can help you with everything from basic bookkeeping and payroll, to compliance and corporate finance. And developing relationships with an accountant at an early stage will help you protect your interests from now until long into the future.

Less is more

Anyone who starts a business has dreams of kitting out a plush office with all the latest gear. It looks good to your customers, and it makes you - and your team - feel great. But is it worth it? Your startup is far better off forgetting about fancy offices and company sports cars until well into the future. Instead, be frugal, only spend what you absolutely need, and keep those overheads down. Your bottom line depends on it.

Prepare for tough times

No one is just going to give you money for your startup idea, or even the products and services you sell. If you need to have large sums of cash to launch, get back to the drawing board and start developing some new ideas, rather than trying to flog yourself at every investor party out there. You need to focus on finding a way to spend your money to start a business, and get your name out there - not to attract investors, who want to see proof of the pudding before agreeing to meet.

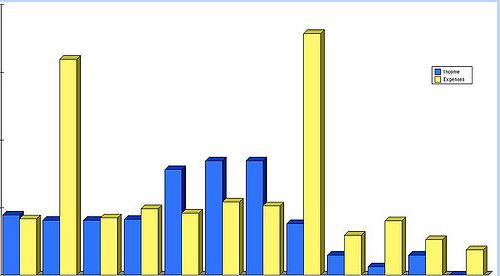

Track everything

Get used to reading financial reports at an early stage. While they might be relatively simple at the moment, they will prove invaluable in the long-term. Profit and loss accounting, sales forecasts, cash flow analytics - these are all subjects you should know about as an entrepreneur, regardless of whether you are using financial services for help.